LifeHack Lesson 3: Reduce Your Travel Tax

Traveling is always a fun activity. More so if you’re traveling to a different

country with your love ones to meet familiar faces and places. However, let’s face it apart from hounding

the net for cheap flights, there’s almost no way in getting around the dreaded

Philippine Travel Tax.

According to the TIEZA (Tourism Infrastructure and

Enterprise Zone Authority), the travel tax is a levy imposed by the government

of the Philippines, under Presidential Decree (PD) 1183, to all departing

passengers. The price depends on the

type of ticket you purchase and only OFW (Overseas Filipino Workers) are fully exempted from paying the

tax. So yes, even you’re kids would need

to pay up.

TRAVEL TAX RATES

|

FIRST CLASS PASSAGE

|

ECONOMY CLASS PASSAGE

|

Full Travel Tax

|

PHP 2,700.00

|

PHP 1,620

|

Standard Reduced Travel Tax

|

PHP

1,350.00

|

PHP

810.00

|

Privileged Reduced Travel Tax

for a Dependent of an

Overseas Filipino Worker (OFW)

|

PHP 400.00

|

PHP 300.00

|

But it’s not all pain.

The tax does go to worthwhile endeavors.

At least half of it.

TIEZA portions that money, with 50% going to TIEZA, 40% to

the Commission on Higher Education (CHED) for tourism-related education

programs and courses. Lastly, the 10%

goes to the National Commission for Culture and Arts (NCCA).

But if you’re a family of 4 going to see Mickey Mouse in Hong Kong, that P1,620 could easily balloon to P6,480—roughly the same price of one passenger ticket to Hong Kong and back.

So, I was very happy to know that I wouldn’t have to pay the full price. Being an OFW dependent, my gang and I can avail the reduced price of P300. An 80% decrease from the full price.

All OFW dependent can avail this privilege, even if you’re not travelling with the OFW. As long as:

1.

Your destination is the same country where your

OFW is deployed.

2.

You’re part of the OFW’s immediately family.

a.

Parents

b.

Spouse

c.

Children

3.

You have proof of family relation

a.

Original NSO copy of Marriage Certificate for

Spouse

b.

Original NSO copy of Birth Certificate

4.

Proof of OFW deployment

a.

Copy of EOC, issued within a year

5.

Passport and Booking confirmation

To avail of the reduced travel tax, go to the TIEZA desk at the airport and submit all your documents. Don’t worry about handing out your NSO files. They will hand it back to you. The most important part is the OEC of the OFW. They should be registered and active in the POEA system.

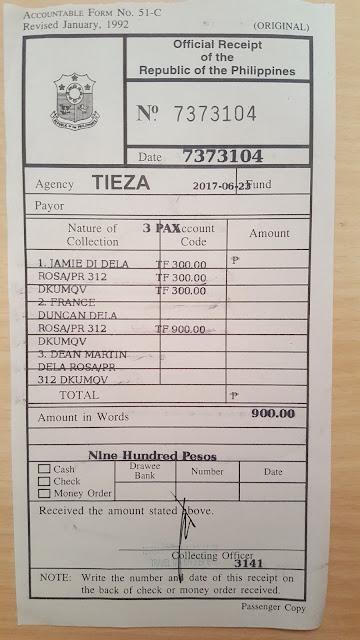

Afterwards, you’ll be asked to pay P300 for each passenger. A receipt and OFW dependent certificate would be given to you. This you’ll present to the check in counter as proof of travel tax payment.

0 comments: